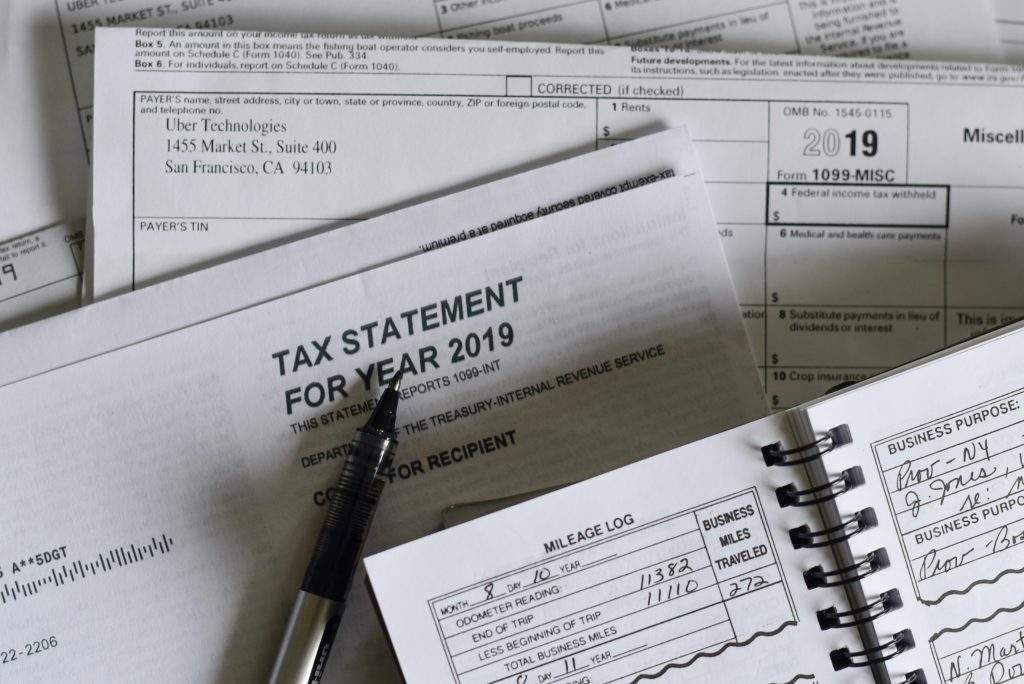

How to Handle Back Taxes and Avoid Penalties

Handling back taxes can feel overwhelming, but addressing the issue promptly can prevent costly penalties and interest from accumulating. At JB Consulting Tax, we specialize in helping individuals and businesses resolve their tax debts efficiently and avoid future complications. Here’s how you can manage back taxes and avoid penalties. Assess What You Owe The first […]

How to Handle Back Taxes and Avoid Penalties Read More »